Planning to buy a property? Learn the process of transferring land titles in the Philippines through this article.

What is a land title?

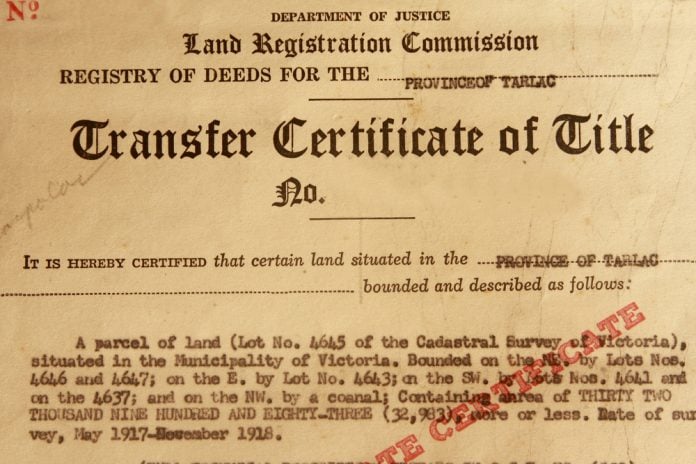

A land title is the final proof of property ownership in the Philippines. The Torrens Title System, land registration, and land transfer system were adopted to document the transfer of property title from the original owner who registered it to subsequent owners.

To transfer the land title into your name or the name of the group of people who own the property once you’ve purchased real estate or property sold, such as a condominium unit or a house and lot. You must study the prerequisites and map out the methods for transferring the land title.

A land title, also known as a certificate of title, is a document that verifies a person’s or group’s right to purchase and acquire property. A property title can also assist landowners and homebuyers in determining existing liens, usage rights, easements, natural resource rights, and other rights.

What ID should I present during the land title transfer?

The acceptable Valid IDs in the Philippines are:

- Passport.

- Driver’s license.

- Professional Regulation Commission (PRC) ID.

- Postal ID.

- Voter’s ID.

- Taxpayer Identification Number (TIN).

- Government Service Insurance System (GSIS) e-Card.

- Social Security System (SSS) card.

- The Unified Multi-Purpose ID (UMID).

*Do not utilize IDs that are passed their expiration date.

What are the responsibilities of the property seller?

The SELLER is in charge of:

- Taxes on real estate are owed.

- 6 percent of the selling price on the Deed of Sale or the zone value, whichever is larger, in capital gains tax.

What are my responsibilities as the buyer during the land title transfer in the Philippines?

The BUYER is in charge of:

- The registration charge is 0.25 percent of the selling price, zone value, or fair market value, whichever is higher.

- The selling price, zonal value, or fair market value, whichever is larger, is taxed at 0.5 percent (in the provinces) or 0.75 percent (in Metro Manila).

- The Documentary Stamp Tax is set at 1.5 percent of the selling price, zonal value, or fair market value, whichever is higher.

- Expenses related to the registration process.

How do you transfer a land title in the Philippines?

1. At the Regional District Office of the Bureau of Internal Revenue, file and secure the transfer of title requirements and required papers (BIR RDO)

- The notarized Deed of Absolute Sale must have (1) an original copy and (2) photocopies (DAS)

- Owner’s duplicate copy and (2) photocopies of the Transfer Certificate of Title (TCT) OR Condominium Certificate of Title (CCT) if condominium units are being sold.

- Certified True Copies and (2) photocopies of the most recent Tax Declaration for land and improvements. *NOTE: If the property transferred is a vacant lot or has had no improvements made to it, at least one of the transferees must sign a Sworn Declaration of No Improvement or a Certificate of No Improvement issued by the city or municipal assessor.

- The Seller’s and Buyer’s Tax Identification Numbers (TINs)

2. Transfer taxes should be assessed at the BIR and Authorized Agent Bank (AAB) OR Municipal OR City Treasurer’s Office.

A BIR agent will calculate your Capital Gains Tax (CGT) and Documentary Stamp Tax after you’ve filed the necessary documentation for land transfer (DST). They will then ask you to sign three (3) copies of Form 1706 of the BIR (CGT) and Form 2000, Bureau of Internal Revenue (DST) then, they’ll be submitted with the AAB. They will be lodged with the Authorized City or Municipal Treasurer in places where there are no AABs.

3. Request a Certificate Authorizing Registration (CAR) or BIR Clearance by submitting documentation to the BIR.

The registration fees are calculated by the RD. The registration fees must be paid. It usually takes two weeks to create a new title. It should now be much faster. BIR RDOs should issue CARs for all One Time Transactions (ONETT) within five (5) days of receiving all required documentation, according to BIR Memorandum Order No. 15-03. You will be given a claim slip with the CAR’s claim date, which will be released with the following documents:

- Original copy of the Absolute Sale Deed, stamped by the BIR as received

- Duplicate Copy of the TCT or CCT owned by the owner

- BIR Form 1706 (CGT) and Form 2000 (DST) original copies, stamped as received by the BIR

- Copies of the Land and Improvement Tax Declaration

4. Send your documents to the Local Government Unit’s Assessor’s Office.

A new tax declaration is issued by the Assessor’s Office. Under the new tax declaration, the new owner is responsible for paying the assessment fees.

Required Documents:

- The original Owner’s copy of the new title must be shown together with a certified true copy of the new title or a photocopy of the new title.

- The previous title has been photocopied.

- a conveyance deeds

- Copy of the most recent tax declaration that has been certified as true (For BIR purposes)

- Receipt for Transfer Tax (original and 2 photocopies)

- If the former owner was a corporation, the following documents are required: Business Tax Receipt / Business Permit (original and 2 photocopies)

- Certificate of Registration from the Bureau of Immigration and Refugees (BIR) (Duplicate and photocopy)

- Clearance of taxes (original and photocopy)

- Images of the property

- If the land is partitioned, a subdivision plan is required.

Read Also: A Beginner’s Guide to Filing Taxes in the Philippines

You’re done after dealing with the Assessor’s Office of the Local Government Unit. The transfer of the land title from the owner to the buyer normally takes three to four months after receiving the transfer tax receipt. Given that you must visit numerous authorities to transfer the land title document into your name, including the BIR, Registry of Deeds, Treasurer’s Office, and Assessor’s Office. It takes effort and patience to go from one agency to another on your own.

Please keep your new title, your new tax declaration, the brown copy of the CAR issued by the BIR, and the official receipt for the certification fee in a secure place.

The land title transfer in the Philippines should be made clear to all parties engaged in the property acquisition process – seller, listing broker, buyer, and buyer’s broker – who should be executing the title transfer. That should have been decided from the beginning. A deed and a land title are frequently confused, although they are not the same thing. A deed is a legally binding written instrument that transfers ownership of land or property from one person to another.

Suggested Read: What To Check On A Lot For Sale Property In The Philippines

Written by Maria Joecel Porteros