There’s a reason why the word taxing means “physically or mentally demanding” – because doing your taxes is really exhausting! If numbers are not enough to make your head dizzy, the several steps in filing your tax returns will definitely make you lightheaded. That is why some people would opt to hire accountants to do the tedious job of reporting their income and expenses before the Bureau of Internal Revenue. However, not everyone has the luxury of hiring other people to do their income taxes. Don’t fret! To make it easier for residents and homeowners of BRIA, we have here a simplified step-by-step process of filing your income taxes, which you have the option to do in the comfort of your own home.

Individuals who are required to file Income Tax Returns

According to the Bureau of Internal Revenue website, you are required to file income taxes if you are a resident citizen sourcing compensation income from all sources, whether inside or outside the Philippines. Further, resident aliens and non-resident citizens are also required to file income tax returns with respect to compensation income from within the Philippines.

This includes, but is not limited to, the following people.

- Employees deriving purely compensation income from employer/s;

- Persons getting other non-business, non-professional similar income in addition to compensation income not otherwise subject to a final tax;

- Individuals deriving mixed-income; and

- Self-employed individuals receiving income from the conduct of a trade or business and/or practice of a profession.

However, individuals earning less than Php 250 000 are exempt from the payment of taxes but are still required to file their income tax returns. Non-individuals, such as domestic corporations, foreign resident corporations, partnerships, or estates and trusts which are engaged in trade or business, are also required to file. However, this article will only discuss the processes involving individuals.

Date of Filing of Income Tax Returns

Individuals should file their income tax returns on or before April 15 of each year covering income for the preceding taxable year. Failure to file on the said date will result to the incurrence of surcharges and interest.

Income subject to Income Tax and Allowable Deductions

Income comprises all wealth that flows into an individual in excess of its capital. Not all types of income, however, are taxable income. Taxable income includes pertinent items of gross income listed in the Tax Code as amended, less any allowable deductions, if there are any, pursuant to the Tax Code or other special laws. According to the BIR, gross income, which is all income derived from any source, includes the following:

- Payment for services, in whatever form paid;

- Gross income obtained from the conduct of a trade or business or through a profession;

- Gains derived from dealings in property;

- Interest;

- Rents;

- Royalties;

- Dividends;

- Annuities;

- Prizes and winnings,

- Pensions;

- Partner’s part from the net income of the general partnerships.

Sources of gross income, however, are not limited to the above-mentioned items. Furthermore, according to the BIR the following are not subject to income tax:

- Life insurance;

- Amount received by insured as return of premium;

- Gifts, bequests and devises;

- Compensation for injuries or sickness;

- Income exempt under treaty;

- Retirement benefits, pensions, gratuities, etc.;

- Miscellaneous items;

- Income obtained by foreign government;

- Income obtained by the government or its political subdivision;

- Prizes and awards in sport competition;

- Prizes and awards obtained which met the conditions set in the Tax Code;

- 13th-month pay and other benefits obtained not exceeding P90,000;

- GSIS, SSS, Medicare and other contributions;

- Gains from the sale of bonds, debentures, or other certificates of indebtedness with a maturity of more than five (5) years;

- Gains from the recovery of shares in a mutual fund.

The above-mentioned items are to be distinguished from the deductions from gross income allowed by law. According to the BIR, taxpayers have two options to choose from with regard to the method of deduction:

- Optional Standard Deduction (OSD) which uses the amount not exceeding 40% of the gross sales/receipts for individuals and gross income for corporations; or

- Itemized Deductions which include the following:

- Expenses

- Interest

- Taxes

- Losses

- Bad Debts

- Depreciation

- Depletion of Oil and Gas Wells and Mines

- Charitable Contributions and Other Contributions- Research and Development

- Pension Trusts

The first option (OSD) is not allowed to non-resident alien individual engaged in trade or business. Further, a General Professional Partnership (GPP) may only opt to OSD once, either by the GPP or the partners comprising the partnership.

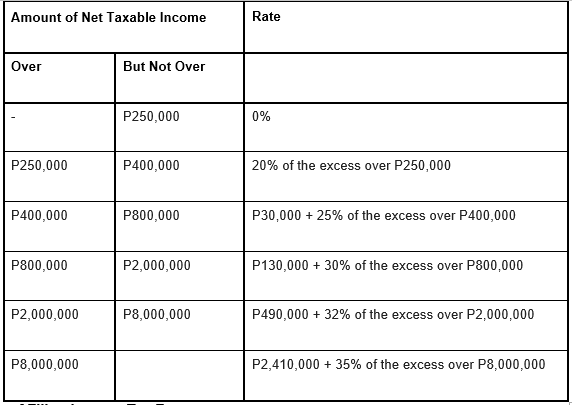

Income Tax Rate

There are various tax rates to compute one’s income tax. The most basic of which is the Graduated Income Tax Rates under the Tax Code, as amended by Republic Act No. 10963:

Methods of Filing Income Tax Returns

There are three modes of filing: manual tax filing, Electronic Filing and Payment System (eFPS), and Electronic BIR Forms (eBIRForms). Manual tax filing is the traditional mode of filing tax returns which necessitates the individual to leave their home to go to the nearest Authorized Agent Bank (AAB) of the Regional/District Offices of the Bureau.

In the advent of technological advances and in keeping up with modern times, the Bureau took advantage of the accessibility of our devices through the development of the digital modes of filing tax returns. The eFPS is for large taxpayers, non-large taxpayers, and other taxpayers included in Revenue Regulations (RR) No. 1-2013. This mode also makes it easier for users to pay their taxes through their online banks. On the other hand, eBIRForms are for those who are not qualified to use eFPS and Accredited Tax Agents (ATA). However, as opposed to eFPS, users of eBIRForms still need to appear before the nearest AAB to pay their taxes.

Process of Filing of Income Tax

The process of filing your tax returns might seem daunting at first. But once you get the hang of it, you can do your taxes in your sleep! Before the filing proper, identifying the correct to be used is essential. Each form is for a specific type of taxpayer depending on the nature of their income. The following the commonly utilized forms and their respective requirements and procedures of filing income tax returns according to the Bureau:

1. Form 1700

For employees deriving purely compensation income from employer/s or individuals deriving other non-business, non-professional related income in addition to compensation income not otherwise subject to a final tax;

Documentary Requirements

- Proof of Income Tax Withheld on Compensation (BIR Form 2316);

- Duly approved Tax Debit Memo, if applicable;

- Proofs of Foreign Tax Credits, if applicable;

- Income Tax Return filed before and proof of payment, if filing an amended return for the same taxable year.

Procedures

A. For Electronic Filing and Payment System (eFPS) Filer:

- Fill out appropriate information in the BIR Form No. 1700

- Pay online by choosing the “Proceed to Payment” button and fill out the required information in the “eFPS Payment Form” then click the “Submit” button.

- Accept payment confirmation from eFPS-AABs for successful e-filing and e-payment.

B. For Non-eBIRForms Filer:

- Fill out the appropriate fields in the BIR Form No. 1700 from the downloaded Electronic Bureau of Internal Revenue Form (eBIRForm) Package

- Print the fully accomplished BIR Form No. 1700

- Go to the nearest Authorized Agent Bank (AAB) under the authority of the Revenue District Office where you are enlisted and file the accomplished BIR Form 1700, including the required attachments and your payment.

- In places where there are no AABs, proceed to the Revenue Collection Officer or duly Authorized City or Municipal Treasurer located within the Revenue District Office where you are registered and submit the duly accomplished BIR Form 1700, plus the required attachments and your payment.

- Receive your copy of the duly stamped and validated form from the teller of the AABs/Revenue Collection Officer/duly Authorized City or Municipal Treasurer.

C. For Manual Filer:

- Fill up the BIR Form No. 1700 in triplicate copies.

- Go to the Revenue District Office where you are registered or to any Tax Filing Center established by the BIR and submit the fully accomplished BIR Form 1700, together with the required attachments.

- Keep your copy of the duly stamped and validated form from the RDO/Tax Filing Center representative.

2. Form 1701

For person earning mixed-income, i.e., professional income and income from the conduct of trade or business and/or practice of profession; and

Documentary Requirements

- Certificate of Income Tax Withheld on Compensation (BIR Form 2316), if applicable;

- Certificate of Income Payments Not Subjected to Withholding Tax (BIR Form 2304), if applicable;

- Certificate of Creditable Tax Withheld at Source (BIR Form 2307), if applicable

- Duly approved Tax Debit Memo, if applicable;

- Proof of Foreign Tax Credits, if applicable;

- Income Tax Return filed before and proof of payment, if filing an amended return for the same year;

- Account Information Form (AIF) or the Certificate of the independent Certified Public Accountant (CPA) with Audited Financial Statements if the gross annual sales, earnings, receipts or output exceed three million pesos (P3,000,000.00);

- Account Information Form or Financial Statements not necessarily audited by an independent CPA if the gross annual sales, earnings, receipts, or output do not exceed P3,000,000.00 and is subject to graduated income tax rates under Section 24(A)(2)(a);

- Evidence of pevious year’s excess tax credits, if applicable.

Procedures

A. For eFPS Filer:

- Fill out applicable fields in the BIR Form No. 1701

- Pay online by clicking the “Proceed to Payment” button and fill up the required fields in the “eFPS Payment Form” then click the “Submit” button.

- Accept payment confirmation from eFPS-AABs for successful e-filing and e-payment.

B. For eBIRForms Filer:

- Fill out appropriate inormation in the BIR Form No. 1701 in the downloaded Electronic Bureau of Internal Revenue Form (eBIRForm) Package

- Print the fully accomplished BIR Form No. 1701

- Go to the nearest Authorized Agent Bank (AAB), or where you are registered and submit the duly accomplished BIR Form 1701, plus the required attachments and your payment.

- If there are no AABs in your place, go to the Revenue Collection Officer or duly Authorized City or Municipal Treasurer stationed within the Revenue District Office where you are registered and submit the duly accomplished BIR Form 1701, plus the required attachments and your payment.

- Receive your copy of the duly stamped and approved form from the teller of the AABs/Revenue Collection Officer/duly Authorized City or Municipal Treasurer.

C. For Manual Filer:

- Fill out the BIR Form No. 1701 in triplicate copies.

- Go to the Revenue District Office where you are registered or to any Tax Filing Center sanctioned by the BIR and submit the duly accomplished BIR Form 1701, plus the required attachments.

- Accept your copy of the duly stamped and approved form from the RDO/Tax Filing Center representative

3. Form 1701A

for self-employed person earning income from the conduct of trade or business and/or practice of profession.

Documentary Requirements

None

Procedures

1. Accomplish BIR Form 1701 AIF in triplicate.

2. Attach the same to BIR Form 1701.

Who knew taxes could be done in the convenience of your own BRIA home? Don’t have a BRIA home yet? No problem. BRIA Homes offer a wide range of affordable homes which can be financed through PAG-IBIG House Loans or Bank Housing Loans. And with the BRIA homes spread over forty locations in the country, it would not be hard to find one which fits your liking. Interested homeowners can view the plethora of choices BRIA has to offer through virtual tours on the official BRIA website.

Source:

AHC Certified Public Accountants

Written by Katherine Kaye Villafuerte