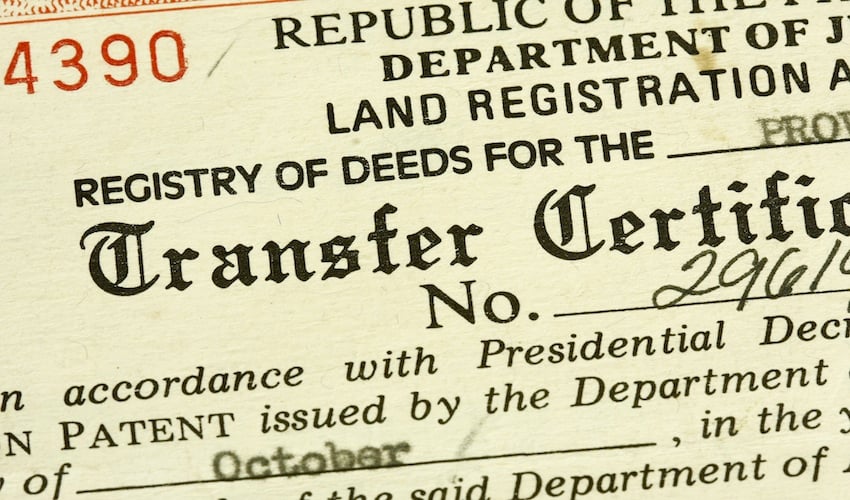

Tax Declaration is a document that reflects the value of real property (Land, Building/Improvement or Machinery) for purposes of Real Property Tax, assessed against the owner/taxable person or entity, as authorized under the Local Government Code (RA 7160), implemented through City Ordinance No. SP-91, S-1993, as amended, or The Quezon City Revenue Code of 1993. The Owner’s Copy of a tax declaration is issued upon registration of transfer of ownership of real property from the previous owner to a new owner, or upon declaration of new building or improvement and machinery. Under existing laws, it is the duty of all persons acquiring property to declare the same with the City Assessor’s Office within a period of sixty (60) days from the issuance of its Transfer Certificate of Title (TCT) or Condominium Certificate of Title (CCT).

What is Land Title

A party may have a legal interest or an equitable interest in a piece of property, and these rights are collectively referred to as the title in property law. The rights included in the bundle could be divided up and controlled by various parties. It may also refer to a formal document that acts as proof of ownership, like a deed. To transfer ownership of the property to another person, the document (transfer of title to the property) may need to be conveyed. Possession, which frequently accompanies ownership but is not always enough to prove it, is different from title (for example squatting). Possession and title can frequently be transferred separately in numerous circumstances. Land registration and recording serve as a public notification of ownership for real estate.

The title report will also identify any applicable encumbrances such as easements, liens, or covenants. Title reports are often written out by title insurance firms and show the history of title (property abstract and chain of title) as determined by the documented public record deeds. In return for premium payments, the title insurance business searches public records for a clear title and guarantees it, paying the insured back if there is a title dispute. A governmental body may provide a straightforward car title document in the instance of vehicle ownership.

Equitable title and Legal Title

- Common law defines equitable title as the right to acquire complete ownership of property when another party still holds the legal title. When a land purchase agreement is carried out, the buyer acquires an equitable [interest/title]. Closing is the process through which legal title is transferred to the buyer once the terms of the sale contract have been satisfied. The term “equitable title” is sometimes used by businesses like Econohomes/Visio Financial to refer to a “trailing deed,”[citation needed] but this is incorrect. Properties that are sold using equitable title have a complete legal chain of title and a transfer that has been recorded with the local municipality.

- Legal title, which results from the purchase of a property, full payment from the seller, and correctly recorded title, constitutes actual possession of the property. Upon the passing of the legal title holder, equitable title dissociates from legal title (owner). For instance, when a person with legal title to property passes away, the property automatically passes to the heirs at law or beneficiaries named in the last will. When an executor or administrator is eligible, they are given the legal title, which they must divest after the estate has been administered in order to properly transfer the title to individuals who have an equitable interest. The “ideal title” is typically the outcome of the union of the legal and equitable. The “perfect title,” also known as marketable title, is created as a result of the union of the legal and equitable. Trust also gives rise to legal and equitable title. One individual, such as the trustees, may own the legal title in a trust. The beneficiary is one possible owner of the equitable title.

Tax declaration to land title requirements

- Original of the instrument or deed. A sworn affidavit signed by the interested party explaining why the original document cannot be supplied must be submitted if the duplicate original or certified true copy of the document cannot be presented.

- certified copy of the property’s most recent tax declaration.

- If the property is titled, the owner’s copy of the certificate of title and, if applicable, copies for each issued co-owner. The true copy of the registration decree or its transcription is referred to as a certificate of title in the Philippines, and it must be signed by the administrator of the Land Registration Authority (LRA). A certificate of title is, in other words, a transcript of the registration decree issued by the Register of Deeds.

How to apply land title from tax declaration

Who May Apply

The following people are eligible to submit an application for registration of their land title, either directly or through properly accredited representatives:

(1) Those who have been in open, continuous, exclusive, and well-known possession and occupation of alienable and disposable lands of the public domain since June 12, 1945, or earlier, either on their own or through their predecessors-in-interest.

(2) People who, in accordance with current laws, have obtained ownership of private lands through prescription.

(3) People who have obtained ownership of private lands or dried-up riverbeds through the legal process of accession or accretion.

(4) People who obtained land ownership through any other legal means.

The application must be submitted jointly by all co-owners of land when ownership is shared. When a property has been sold through a pacto de retro, the vendor a retro may submit an application for the property’s initial registration; however, should the redemption period expire while the registration process is ongoing and ownership of the property is consolidated with the vendee a retro, the latter will take the applicant’s place and be permitted to proceed with the registration process.Unless specifically prohibited by the document establishing the trust, a trustee may submit an original registration application on behalf of his principal for any land held in trust by him.

Form and Contents

The request for land registration must be made in writing, signed by the applicant or a representative who has the proper authority to act on his behalf, and sworn to before an officer who is qualified to administer oaths in the province or city where the application was really signed. If there are multiple applicants, each must sign and swear to the application on their own behalf. The application must include a description of the property, the applicant’s citizenship, civil status, whether they are single or married, the names of their spouses, and, if their marriage has been legally dissolved, the date and manner in which their marriage ended. Additionally, if known, the full names and addresses of all landowners and bordering owners must be included. If not, the extent of the search undertaken to locate them must be stated.

Supporting Documents

The following documents must be included with the application, either as originals or copies:

1. Two (2) blue print copies that have been properly certified by the aforementioned officers, as well as the original plan in tracing cloth that has been duly approved by the Director of Lands, Regional Lands Director, and Regional Technical Director.

2. Three (3) copies of the LRC Circular No. 365-compliant technical description, fully validated and approved by the Regional Technical Director or his designee.

3. three (3) copies of the surveyor’s or geodetic engineer’s certificates, or a regional technical director’s certificate of non-availability;

4. The most recent Tax Declaration or Assessment Certificate from the Assessor’s Office where the land is located, in four (4) copies.

The application must include the following details:

1. The land’s description

2. Civil Status of the Requester If you’re married, mention your spouse’s name. If distinct (when, where and what court gives the order of separation). Indicate the age of the applicant if they are underage.

3. Complete name and address of the application, the current landowner, the owners of the surrounding lands, if known, and, if not, a statement describing how they will be located. Include the full name and address of the legal guardian if a minor.

4. The applicant’s citizenship.

Outline of Steps

The overall flow of the adoption process is outlined below. Please be aware that these steps might not always be followed.

1. Petition submission. The Regional Trial Court of the province or city where the land is located is where the application for land registration should be submitted. Only specific land registration courts will be chosen to hear cases concerning land registration issues. This process will take a week or so.

2. The hearing notice. The court must issue an order specifying the date and time of the initial hearing five days after the application is filed.

The initial hearing of the land registration application will be announced to the public via publication, mailing, and posting.

3. First hearing. The initial hearing must take place no earlier than 45 days from the date of notice and no later than 90 days after that.

4. Oppositions. On or before the first hearing date, or within whatever further time the court may permit, any person claiming an interest, whether or not identified in the notice, may appear and file an opposition. The opposition must be signed and attested to either the applicant or another person with proper authorization, and it must include all of the objections to the application as well as the interest that applicant claims in the matter. The court may order the parties to submit an approved subdivision plan if there is an undivided co-ownership, competing claims of ownership or possession, or overlapping of boundaries, or if the opposition or adverse claim of any person only pertains to a portion of the lot and that portion is not properly delimited on the plan attached to the application.

5. Nothing to oppose. If no one shows up and responds within the allotted time, the court will grant the applicant’s motion to record a default and require the applicant to provide evidence if there is no evidence to the contrary. The globe is deemed a defendant by virtue of the description in the notice “To Everyone Whom It May Concern,” and the case will be resolved by default order. A default order will be made against those who failed to appear and respond in cases where an appearance has been entered and an answer has been submitted.

6. Evidence is presented

7. Decree. The court will decide on any disputed claims of title and interest in the property at issue in the application. If the court determines that the applicant or oppositor has sufficient title suitable for registration after reviewing the evidence and the reports of the Commissioner of Land Registration and the Director of Lands, judgment shall be rendered confirming the applicant’s or oppositor’s title to the land or portions thereof.

The court may issue a partial judgment where only a piece of the land up for registration is in dispute, provided that an authorized subdivision plan illustrating the contested and uncontested portions was previously filed.

The judgment entered in a land registration process is considered final once the thirty-day period starting from the day notification of the judgment was received has passed. The court’s decision may be appealed, just like in regular civil proceedings.

The court shall order the issuance of the decree of registration and the related certificate of title in favor of the person determined to be eligible to registration after the judgment has become final and executory.

Depending on a number of variables, including the court’s availability, the complexity of the case, the presence of opposing parties, the accessibility of witnesses and documentary evidence, and the location of the petition’s filing, the original registration process may take anywhere from a year to as long as five years to complete.

One of the biggest real estate firms in the nation, GOLDEN MV Holdings, Inc., is the parent company of BRIA Homes. BRIA Homes is ready to deliver quality and reasonably priced condominium units and house and lot packages to everyday Filipino families. Every single person at the company is driven by this objective, and the ultimate fulfillment comes when a client successfully moves into one of BRIA’s properties.

Visit bria.com.ph to get more information!

Written by Bermon O. Ferreras