Purchasing real estate is one of the most significant investments that most Filipinos make. The distinction between a mortgage term vs an amortization period is one of the most prevalent forms of uncertainty for potential home buyers. Acknowledging how amortization vs mortgage functions can help you determine which mortgage type is ideal for both you and your family. Continue reading this article to know what is the difference between mortgage from amortization.

Read also: Different Types of Bank Loans in the Philippines

What is an Amortization?

The word “amortization” entails two distinct scenarios. To begin, amortization is a term used to describe the method of repaying debt by making regular principal and interest payments over a period of time. An amortization schedule is used to make installment payments on a loan, such as a mortgage or a house loan, to decrease the existing balance. Second, for accounting and tax purposes, the amortization can also be defined as the process of distributing out capital costs associated with intangible assets over a specific time frame over the asset’s useful lifetime.

Amortization is an accounting technique that is used to reduce the book value of a loan or an intangible asset on a regular basis over a specified amount of time. When it comes to loans, amortization is the process of distributing loan payments over time. Amortization is similar to depreciation when subjected to an asset. Amortization is the amount of time required to pay off the entire mortgage loan using regular payments at a fixed interest rate. A long amortization period reduces monthly payments, however, the interest rate also influences the total cost of the mortgage. If you opt to trim down the amortization period, the overall cost of the mortgage will be significantly smaller. This is due to the fact that, despite the larger monthly payments, there will be fewer months of interest payments to make.

What is a Mortgage?

The mortgage term is the written agreement that binds the consumer to the general values and takes into account the mortgage loan’s rates and terms. Although the most common term is five years, the typical time frame for a full mortgage term can range from six months up to ten years. The lesser the interest rate, the shorter the mortgage term. A mortgage term renewal is a contract readjustment in accordance with the principle that exists. When your mortgage term is up but you still face charges, you must renew it. This process enables you to go over the existing conditions, such as the loan company profile, payment timing, interest rate, and new term duration.

Short-term mortgages, those with five years or less, can have fixed or variable interest rates, whereas longer-term mortgages are typically limited to fixed rates. If you choose a fixed-rate mortgage and need to cut your contract before the term ends — such as, to sell your property — you might very well face significant prepayment penalty fees.

If you want to avoid being locked into yet another mortgage term with your existing mortgage lender, you should consult with your mortgage advisor and try working forward to another mortgage contract. But even so, changing lenders requires relying on up-to-date interest rate patterns, as they can fluctuate over time, resulting in the final investment being either favorable or costly. Since switching lenders involves some bureaucracy, the previous step should be completed as promptly as possible prior to the actual end of the mortgage term. Examples include a new lender profile and additional criteria that may necessitate submitting a mortgage loan proposal, as well as proving your income, property ownership, and property insurance.

You will have to choose your mortgage term carefully, taking into consideration your present financial status, the duration of time you intend to keep your home, your estimated financial future, as well as potential interest-rate fluctuations and shifts in the country’s economic growth.

How does mortgage vs amortization work in real estate?

Because of the home equity, the acquittal of a real estate loan is frequently an important phase toward promoting independence from any other type of financial lending. When the amortization period is completed, the financed property will become yours to preserve with no debt. This is more advantageous in many ways than renting. Only after full amortization payment, the mandate of permanent homeownership security will guarantee financial freedom from the loan company.

In the case of high-priced property ownership, the long-term loan payment may be the best option for amortization because the implications on the monthly budget are reduced. If you want to get out of debt as soon as possible and attempt to limit higher interest rates, you could perhaps favor paying back the loan quickly.

- Fixed-Rate Mortgages

A fixed-rate mortgage is an excellent choice for those who intend to remain on their property for an extended period of time. These loan payments have a fixed interest rate for the lifetime of the contract. The portion a borrower pays may vary depending on local tax and insurance rates, but fixed-rate mortgages give a clear predictable monthly payment for accounting purposes.

The majority of the monthly payment is subject to interest at the start of a fixed-rate mortgage. Which thus fluctuates over time, and as the interest balance lessens, a greater portion of the monthly payment is attributed to the principal.

- Adjustable-Rate Mortgages (ARMs)

Often these adjustable-rate mortgages (ARMs) have just a 5- to 7-year introductory period during which the borrower owes a fixed interest rate that is typically below the market rate. When the introductory period expires, the lender will use a predetermined index to find the suitable rate for the borrower.

If market interest rates rise, the borrower may face an upsurge. If market rates have dropped, the borrower’s interest rate may have dropped as well. The maximum and minimum interest rates that an ARM can accrue are limited.

- Interest-Only Mortgage

Interest-only mortgages can be a good option for individuals who wish to buy a house while keeping their monthly payments minimal. A 30-year interest-only loan allows the borrower to compensate only interest for the first ten years. Then, for the rest 20 years of the loan term, principal and interest payments would be rendered.

- Balloon Mortgages

A balloon mortgage is any form of loan that includes a one-time lump sum payment made at any moment in time during the term. Balloon loans can be arranged in a variety of ways. They can be interest-only payments during the initial establishment, as previously discussed. May other balloon mortgages include principal and interest in monthly payments, however the borrower ought to be capable of dealing with the lump sum payment, which typically takes place at the end of the loan’s duration.

Conclusion

Acknowledging how amortization vs mortgage works can help you determine which type is best for you and your family. If you are granted a relatively short amortization period or receive a pile of cash and pay off your current mortgage, you will witness the start and finish of numerous mortgage terms over the course of your loan. However, your remainder amortization will be relatively short at the end of each term since you have consumed the transitional months or years paying off debt a portion of the principal loan.

Understanding what is the difference between mortgage from amortization can have an impact on your mortgage versatility and cost of borrowing. It is critical to find a compromise that is appropriate for your financial circumstances in both the short and long term. It can be a difficult and perilous tangle to traverse, so make sure to speak with your mortgage lender if you have any important questions.

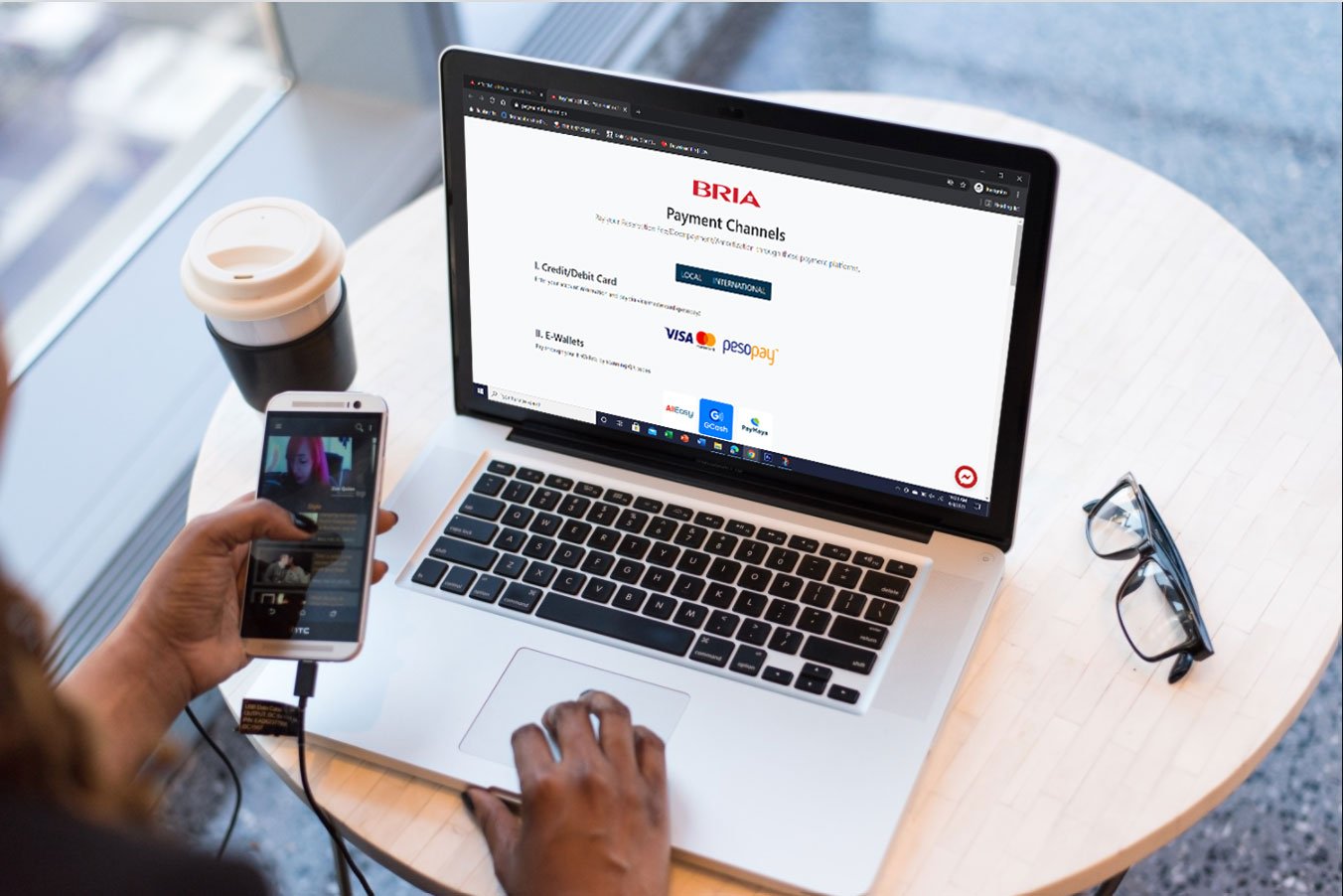

If you are looking for an ideal real estate property to invest in, then you may check out the different properties available from BRIA Homes. BRIA Homes primes itself on developing affordable house and lot packages and easy-on-the-pocket condominium units that cater to ordinary Filipino families who aspire to acquire their own homes. It had become the perfect choice for average Filipino workers who wanted to invest in a high-quality and affordable home. Visit www.bria.com.ph to reserve your very own BRIA property today!

Read also: How to Get a Pre-Approved Bank Housing Loan?

Written by MC Sanchez