Many of us continue to aspire to have our own dream house for our family. A place where they can find peace amidst the fast-changing society; a place for a good rest after a long and tiring working day. However, many worry about how to afford the ever-increasing fair market price of all real estate properties, including the various residential units like house and lot and condominium units. This article will provide you where you will get the best home loan options on how you will be able to meet the financial challenges and responsibilities of acquiring a home you can call your own.

What are your home loan options in the Philippines?

1. Home Development Mutual Fund or the Pag-IBIG fund

In the Philippines, the government offers affordable home loans with low interest rates through the Home Development Mutual Fund or the Pag-IBIG Fund. Though there are other government agencies that offer similar services, Pag-IBIG is the lead agency for many Filipinos seeking financial assistance as they start their journey in purchasing or constructing their dream homes.

Read Also: Pag-IBIG Housing Loan: A Comprehensive Guide on How to Avail

What is the Home Development Mutual Fund?

As part of the quest of the Philippine Government to provide housing to many Filipinos through affordable housing loans, the Home Development Mutual Fund (HDMF) or Pag-IBIG was established on 11 June 1978 by virtue of Presidential Decree no. 1530.

Nowadays, the Pag-IBIG Fund is now under the Department of Human Settlements and Urban Development (DHSUD). Under Republic Act no. 9679, the following are the automatic members of the Pag-IBIG and thus, required to make contributions to avail of all the benefits and services offered by the Fund:

- all employees in the private and public sectors;

- Filipinos employed by foreign-based employers; and

- spouses who devote full-time to managing the household and family affairs, unless they also engage in another vocation or employment which is subject to mandatory contributions

How much do we contribute to Pag-IBIG?

All covered members of the Fund are required to contribute according to their monthly income. All members of the Pag-IBIG that are earning Php 1,500.00 and below are subject to 1% mandatory contribution while those earning more than Php 1,500.00 are subject to 2% mandatory contributions. Furthermore, all the employers of all the members are mandated to provide 2% of their employees’ monthly compensation over the contribution of the Pag-IBIG member.

For example, if you’re earning Php 5,000.00 per month, the employer’s share is Php 100.00 (Php 5,000.00 x 0.02 = Php 100.00). You’re also paying Php 100.00 with your employer for that contribution.

What are the home loan options in Pag-IBIG?

So if you are an active contributor of Pag-IBIG Fund for 24 months, it is more likely that you will be eligible for their various home loan offers – of course, subject to their terms and conditions and requirements. You may obtain your affordable house and lot or condominium unit through the following home loans:

- Pag-IBIG Housing Loan

- Pag-IBIG Home Equity Appreciation Loan (HEAL)

- Affordable Housing Loans for Minimum Wage Earners

- Home Saver Program

- Acquired Assets

Read Also: How to Maximize Your Pag-IBIG Housing Loan Contributions

How to apply for a home loan in Pag-IBIG?

A qualified member will be evaluated based on their capacity to meet the financial responsibility of having a home loan. After this thorough evaluation process, the member can borrow an amount from Php 500,000.00 up to Php 6,000,000.00 depending on their monthly contribution, which shall be based on the lowest of the following:

- The Member’s Actual Need,

- His Loan Entitlement Based On Capacity To Pay,

- The Loan-To-Appraisal Value Ratio.

How much is the interest in Pag-IBIG housing loan?

Like any other type of loan, Pag-IBIG housing loan has an interest rate that varies from 5.750% to 10.000%. The basis of the difference in terms of interest rates on the repricing period that you will choose.

| 1-Yr* Fixing | 5.750% |

| 3-Yr Fixing | 6.375% |

| 5-Yr Fixing | 6.625% |

| 10-Yr Fixing | 7.375% |

| 15-Yr Fixing | 8.000% |

| 20-Yr Fixing | 8.625% |

| 25-Yr Fixing | 9.375% |

| 30-Yr Fixing | 10.000% |

Is there an age requirement to avail the Pag-IBIG housing loan?

There are other eligibility requirements that the Fund specified for their Housing Loans. The debtor should not be more than 65 years old at the date of loan application and is not more than 70 years old at the date of loan maturity. Also, he or she should have no Pag-IBIG housing loan that was foreclosed, canceled, bought back, or voluntarily surrendered.

What documents do I need to apply for a Pag-IBIG Home Loan?

Any loan application will not proceed without the documentary requirements you need to apply. These documents will be the initial basis for the Pag-IBIG to assess your capacity to meet the forthcoming financial obligations of having any of the Fund’s housing loans. Below is the common set of requirements that the Pag-IBIG will be asking from their members:

1. Housing Loan Application with recent ID photo of borrower/co-borrower (if applicable) (2 copies, HQP-HLF- 068/ HQP-HLF- 069)

2. Any of the following proof of income:

2.1. For Locally Employed

- Certificate of Employment and Compensation (CEC), indicating the gross monthly income and monthly allowances or monthly monetary benefits received by the employee (1 original copy) duly signed by the authorized signatory of the employer. For system generated CEC, the signature of authorized signatory of the employer must be reflected in the said CEC.

- Latest Income Tax Return (ITR) for the year immediately preceding the date of loan application, with attached BIR Form No. 2316, duly acknowledged by the BIR or authorized representative of the employer. (1 photocopy)

- One (1) Month Payslip, within the last three (3) months prior to date of loan application with name and signature of the authorized signatory of employer. (1 certified true copy)

2.2. For Self-Employed

- ITR, Audited Financial Statements, and Official Receipt of tax payment from bank

- supported with DTI Registration and Mayor’s Permit/Business Permit

- Commission Vouchers reflecting the issuer’s name and contact details (for the last 12

- months)

- Bank Statements or passbook for the last 12 months (in case income is sourced from

- foreign remittances, pensions, etc.)

- Copy of Lease Contract and Tax Declaration (if income is derived from rental payments)

- Certified True Copy of Transport Franchise issued by appropriate government agency (LGU

- for tricycles, LTFRB for other PUVs)

- Certificate of Engagement issued by owner of business

- Other documents that would validate the source of income

2.3. For Overseas Filipino Workers (OFW)

Employment Contract:

- Employment Contract between employee and employer; or

- POEA Standard Contract

- Notarized Certificate of Employment and Compensation (CEC)

- CEC written on the Employer/Company’s official letterhead; or

- CEC signed by employer (for household staff and similarly situated employees) supported by a photocopy of the employer’s ID or passport

- Income Tax Return filed with Host Country/Government

2. Home Loans Through Bank Financing

Another avenue for you to finance your dream house and lot is through bank financing. Bank Financing, often referred to as housing loans or home loans, is a means to borrow a certain amount of money from a bank or any financial institution to meet the financial responsibility of purchasing any real estate including a house and lot.

In the Philippines, there are numerous banks, both private and public financial institutions, that offer a wide array of home loans. Most of the time, bank financing has lower interest rates compared to Pag-IBIG housing loans and in-house financing with interest rate commonly starts with 4.99%.

Read Also: Understanding bank home loans: How do they work?

What are the things you should consider before applying for a bank housing loan?

Are you considering exploring this home loan option? There are salient points you need to consider before proceeding.

1. You Should have a Good Credit Score

Albeit Pag-IBIG conducts their own credit evaluation, nothing is more stringent in doing this evaluation than the banks. Credit scores show the creditworthiness of the debtor based on his or her credit history. In the Philippines, the credit score ranges from 300 to 850. The best credit score you can get is 850 but 700 to 759 is already a good credit score to have. So if you are planning to avail of bank financing to purchase your dream home, better start checking and improving your credit score now!

2. Your Employment Status

The primary source of income for many Filipinos is their employment. That is why it is not surprising to note that banks also look into your employment status and history to give them assurance of your capacity to meet the financial obligations of acquiring any home loans. Usually, banks will require their applicants to be tenured and should at least be employed for a minimum of 2 years.

Aside from the time of tenureship, another important aspect that banks evaluate is your gross monthly income because for you to avail of any home loans, you should be able to meet the minimum income to be qualified.

3. Conditions of Payment

Payment terms for those working here in the Philippines is up to 20 years. On the other hand, those working overseas are only limited to 15 years to settle their home loans. Meanwhile, both Overseas Filipino Workers or OFWs and domestically employed individuals who are applying for any home loans through bank financing should have a net discretionary income of 30%. Those who are self-employed may enjoy these home loans offered by various banks and financial institutions. Usually, they need a quarter of their net income on hand.

This shorter period to meet all the financial obligations of any home loans, especially through bank financing will resort to lower interest rates. Furthermore, this only indicates that the faster you pay off your obligations, the more you can save money. The loanable amount for the bank is higher than Pag IBIG. This means you can pay a lower down payment if you choose bank financing, while in Pag-IBIG financing, your down payment is based on the approved loan, which in return is based on the appraisal value.

What are the usual requirements in a bank housing loan?

Unlike the Pag-IBIG Housing Loan, requirements for home loans through banks are more rigorous and stringent. Though the requirements of various banks differ, here are some of the common requirements that applicants need to submit.

- Home Loan Application Form

- 2 x 2 Photos (both spouses / co-obligor)

- Photocopy of valid ID

- List of acceptable ID: Driver’s License, Passport, SSS ID, Company ID (if Top 5,000 Corporation), Postal ID, PRC ID

- Photocopy of deposit passbooks or bank statements (3 months)

- Marriage contract (if applicable)

Read Also: How to Get a Pre-Approved Bank Housing Loan?

3. In-House Financing in Home Loan Options

Another housing loan option to finance your dream home is through in-house financing. This kind of financing is provided by the developers of their potential consumers or customers. It allows people to directly purchase and finance the expenses from the real estate developer.

Flexibility in In-House Housing Loan

Compared to the earlier financing methods presented above, purchasing your new home through this option will be more flexible. As real estate developers do not rely on the financial sector for funding, this means that they are the ones carrying the risk that homebuyers may opt not to continue paying off the agreed total contract price of the home.

The interest rates in in-house financing are normally identified by the developer in the event that the homebuyer fails to comply with the loan payments and agreements. This flexibility comes with imitation in terms of choosing the actual property you may purchase as the real estate developer may only offer in-house financing to residential units that they can afford to take the risk. That is why in-house financing is commonly offered to units that are in the pre-selling stage to easily manage their risks.

Why should you avail in-house housing loan?

But on the other hand, this option provides another opportunity for those who do not have a good credit score or history since real estate developers can choose a possible consumer to own a home as long as they will be able to meet the less stringent requirements and evaluation process they provide compared to bank financing.

Read Also: What Does In-House Financing on Your Affordable House and Lot Mean?

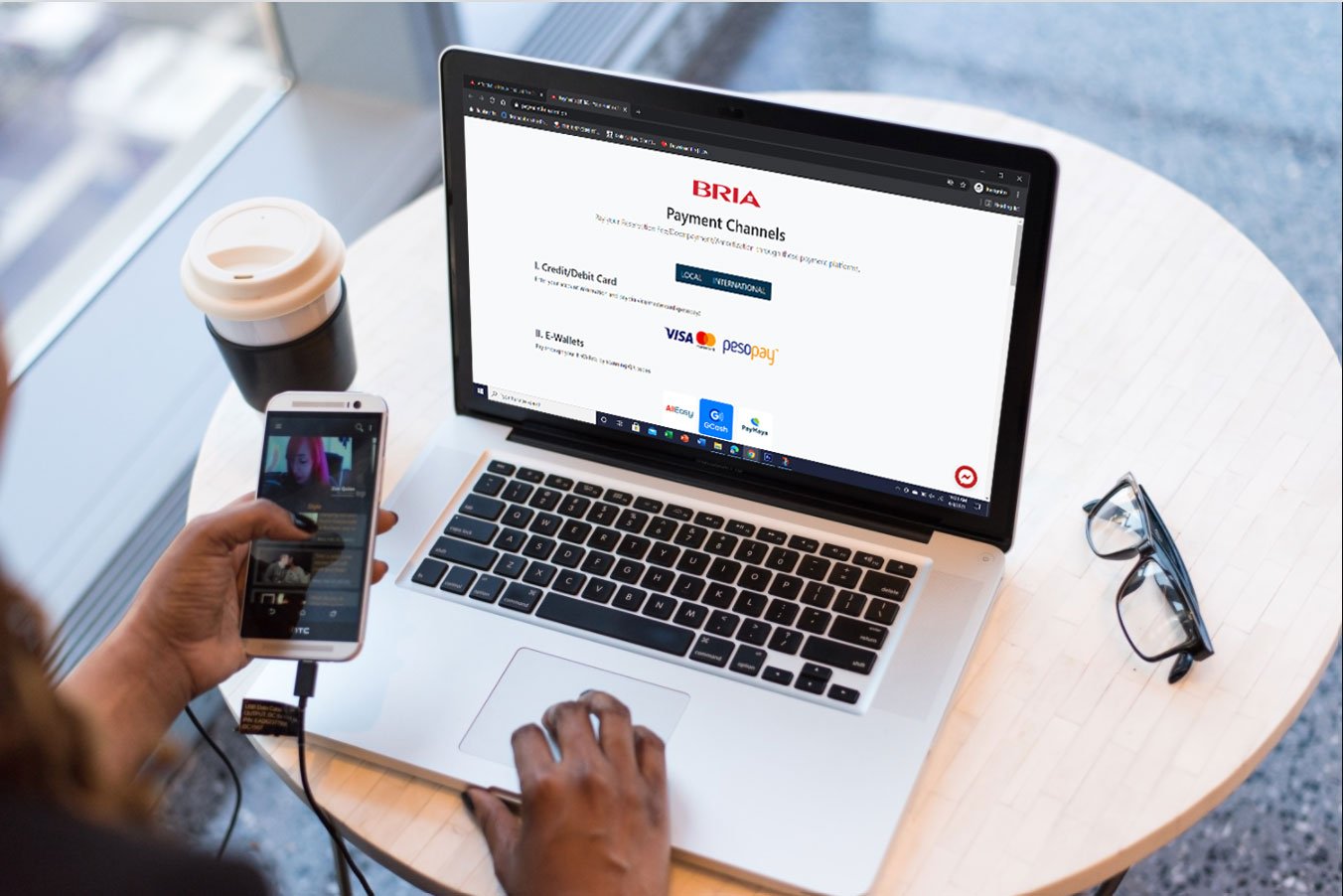

No matter what financing option in housing loans you have in mind, Bria Homes will be pleased to assist you in identifying the best option that fits you as you begin your journey to having your own dream home. You may contact Bria Homes’ able agents and brokers through our official website!